Gas giants, government strike domestic supply deal to avert looming gas crunch

Major gas producers have promised to offer all available LNG supply to Australian buyers before shipping it overseas in a deal with the federal government to prevent a predicted shortfall on the east coast next year.

But Australia’s gas buyers are disappointed the agreement fails to address the soaring gas price, warning high energy costs are pushing some manufacturers to breaking point.

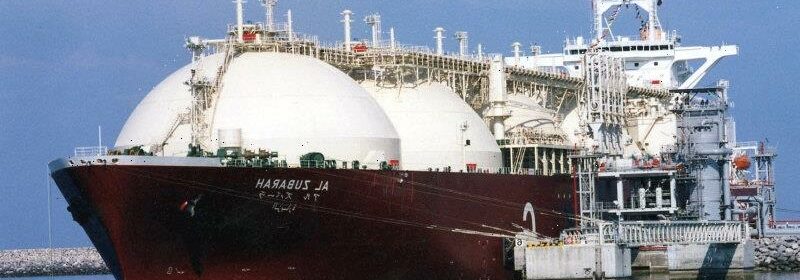

The Albanese government has claimed a win under a deal with LNG exporters to supply the domestic market. Credit:AP

The competition watchdog last month forecast a shortage of 56 petajoules in 2023 – about 10 per cent of domestic demand – escalating concerns over rising costs for gas-reliant manufacturers, and prompting Resources Minister Madeleine King to threaten unprecedented export controls if the industry failed to boost domestic supply.

Queensland producers Origin Energy-backed APLNG, Shell’s QCLNG joint venture and Santos’ GLNG committed on Thursday to offer 157 petajoules to the domestic market before overseas clients over the next 12 months.

King, who had renewed warnings exporters would face penalties in recent days, hailed the deal as a win, saying it included several measures that would “put downward pressure on prices” for local gas buyers.

The agreement requires producers to provide more information to the market on the amount of gas produced and volumes available at any given time.

LNG companies have also committed to offering gas contracts to local buyers at no more than the cost of the export spot market less the price of processing and shipping, known as the netback price.

“This agreement will ensure Australians continue to have access to secure and reliable gas,” King said.

Australia’s trading partners, which are grappling with gas shortages due to a global energy crunch caused by a ban on Russian exports, have been pressuring the government to ensure export contracts are not disrupted by domestic policy.

King said the heads of agreement ensured LNG companies’ export contracts were not affected.

But Andrew Richards, the chief executive of Energy Users Association of Australia, which represents gas users such as food processors and brickmakers, said the deal “ignored the elephant in the room, which is price”.

“It seems to further entrench the link between international spot prices and domestic gas prices, which at the moment are trading at up to 600 per cent above the cost of production,” he said.

King said she was “not willing to see any business close” due to gas price pressures, arguing the deal would provide more price certainty for buyers that had been holding out for government price caps.

“We are in an open international market. We made this country face the world in the 1980s and it has been responsible for a great deal of prosperity. The flip side of that is when there is an international price crisis like now, we do get those knock-on effects,” she said.

“I expect manufacturers now to be able to start negotiations that they might have been putting off [due to their] somewhat unfounded expectation that there might have been a very low price cap put on what is an open market and has been for some time.”

Australian Petroleum Production and Exploration Association chief executive Samantha McCulloch said the deal confirmed the LNG producers’ commitment to the domestic market and avoided the government imposing export controls.

“The industry has always been committed to delivering reliable and competitively priced gas supplies to the domestic market,” she said.

The government is still reviewing its power to impose export controls and has left open the prospect of creating a trigger mechanism that could be pulled sooner than every 12 months. Export controls can be imposed under the current Australian Domestic Gas Security Mechanism, whose rules King is updating.

Wentworth MP Allegra Spender said on Wednesday LNG companies had held the Australian market to ransom by refusing to offer gas at a fair price and urged the government to impose price controls.

“The answer isn’t more fossil fuel projects. The government must consider domestic price caps and a super-profits tax,” she tweeted.

Cut through the noise of federal politics with news, views and expert analysis from Jacqueline Maley. Subscribers can sign up to our weekly Inside Politics newsletter here.

Most Viewed in Politics

From our partners

Source: Read Full Article