Apple stock hits all-time high, tech giant on brink of $3T valuation

Apple stock hits an all-time high – putting the tech giant on the brink of $3 trillion valuation and cementing its status as the world’s biggest company

- Apple stock hit a new record high on Wednesday, touching $189.90 intraday

- A closing price above $190.74 would give the company a $3 trillion valuation

- Apple is already the most valuable company in the world, ahead of Microsoft

Shares of Apple have hit a new all-time high, pushing the company’s market valuation closer to the $3trillion mark once again.

Apple stock hit a new record high on Wednesday, touching $189.90 in afternoon trading, giving the company a total market valuation of roughly $2.98 billion.

The iPhone maker’s shares would need to close at or above $190.74 to reach a $3 trillion market cap, a measure of valuation that totals the price of all a company’s outstanding shares.

It would not be the first time Apple has hit a $3 trillion valuation, but changes to the size of the company’s stock float mean a higher share price is now required to hit the symbolic benchmark.

Apple originally became the first company to cross the $3 trillion valuation threshold in January 2022, when share prices briefly edged above $182 in intra-day trading.

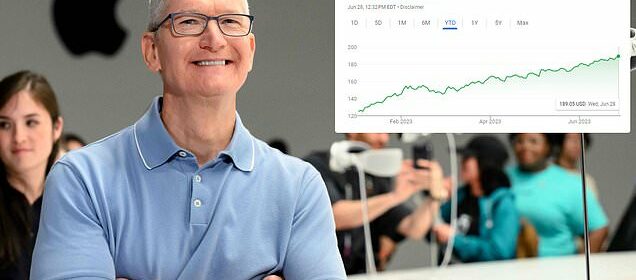

Apple CEO Tim Cook is seen this month with the company’s Vision Pro. Apple stock hit a new record high on Wednesday, touching $189.90 in afternoon trading

Shares of Apple have hit a new all-time high, pushing the company’s market valuation closer to the $3 trillion mark once again

Since then, Apple has conducted major stock buybacks, meaning that there are fewer shares on the market, and a higher stock price is required to hit the same overall valuation.

Apple is already the most valuable company in the world, followed by Microsoft ($2.5 trillion), Saudi Aramco ($2.08 trillion) and Google-parent Alphabet ($1.52 trillion), according to ranking site Companies By Market Cap.

However, the most valuable public company in history remains the Dutch East India Company, which hit a valuation of roughly $9 trillion, at today’s prices, during the Tulip Mania of the 1630s.

Shares of Apple have gained healthily this year, rising more than 50 percent since the start of January.

Tech megacap stocks have generally performed well this year, thanks to surging investor interest in artificial intelligence, as well as signals that the US Federal Reserve is nearly done hiking interest rates.

Generative AI has become the tech world’s biggest buzzword ever since Microsoft-backed OpenAI released ChatGPT late last year, revealing the capabilities of the emerging technology.

However, Apple has mostly resisted the hype, and made no mention of AI when it unveiled its latest slate of new products, including its Vision Pro mixed reality headset.

Apple defied most predictions this week and made no mention of artificial intelligence when it unveiled its latest slate of new products this month, including its Vision Pro mixed reality headset.

Apple officially debuted Vision Pro on June 5, and described it as the first Apple product ‘you look out of and not at.’

The headset lets users merge the real world with a digital one navigated by their eyes, voice and hands – with no controllers needed.

Shares of Apple have gained healthily this year, rising more than 50 percent since the start of January

Vision Pro has a single, thick band on the back of the head, connecting a large, sleek screen that sits over the eyes.

The new AR headset starts at $3,499 and will be available early next year.

The first glimpse of Vision Pro had little impact on Apple stock though, as investors considered whether the expensive new product would boost sales.

‘Wealthy, techie early adopters will buy the Vision Pro in droves, but still years to move the needle for the mammoth Apple,’ said David Rolfe, chief investment officer of Wedgewood Partners that has owned Apple stock since 2005.

Rolfe told Reuters there was not yet a mass market for the headset but lauded the product’s technological innovation.

‘Apple’s Vision Pro reminds me of the very early days of the personal computer revolution,’ he said. ‘It took many years for the PC to become a mainstream product. Same with VisionPro.’

Source: Read Full Article