Elon Musk sells $7billion worth of Tesla shares

Elon Musk sells $7BILLION of Tesla shares and claims the funds could be used to finance Twitter deal if he is forced to buy the social media giant

- The Tesla boss sold some 7.9million shares between August 5 and 9, around 15%

- Musk said he took the money out to avoid an ’emergency sale of Tesla stock’

- The cash could act as insurance in case Musk is forced into buying Twitter

Elon Musk has sold nearly $7billion worth of Tesla shares, according to legal filings published Tuesday, trying to avoid a fire sale if he is forced into buying Twitter in a court battle set for October.

The Tesla boss sold some 7.9million shares between August 5 and 9, according to filings published on the Securities and Exchange Commission’s website.

He now owns 155.04 million Tesla shares, or just under 15% of the automaker, according to Reuters.

‘In the (hopefully unlikely) event that Twitter forces this deal to close and some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock,’ Musk, the world’s richest man wrote on Twitter late Tuesday.

The cash could act as insurance in case Musk is forced into buying Twitter, a company he originally agreed to buy and then walked away from.

Musk, the richest man in the world, holds the majority of his wealth in car manufacturer Tesla – but if a court should rule against him, the stock price could plummet.

Dan Ives, an analyst at Wedbush Securities, said investors will see the chances of a Twitter deal as ‘more likely now’.

His dispute with Twitter started when Musk bought a 9.1% stake in the company, a move which may have violated security laws, then signed an agreement to buy the social media giant on April 25.

Musk said his recent decision to sell millions of Tesla shares is meant ‘to avoid an emergency sale of Tesla stock’

But Musk in early July tore up his agreement to buy Twitter for $44billion after tech stocks across the US started to sink in price, including Tesla’s.

Twitter then sued Musk to force him to complete the transaction, dismissing his claim that he was misled about the number of spam accounts on the social media platform as buyer’s remorse in the wake of a plunge in technology stocks.

Musk has filed a countersuit, accusing Twitter of fraud and alleging the social media platform misled him about key aspects of its business before he agreed to a $44billion buyout.

The two sides are now locked in a legal battle over Musk’s effort to walk away from the April agreement to buy the company, and a judge has ordered a trial to begin on October 17.

The move comes after Musk sold around $8.5billion worth of shares in the electric carmaker in April as he was preparing to finance the Twitter deal.

He tweeted at the time: ‘No further TSLA sales planned after today.’

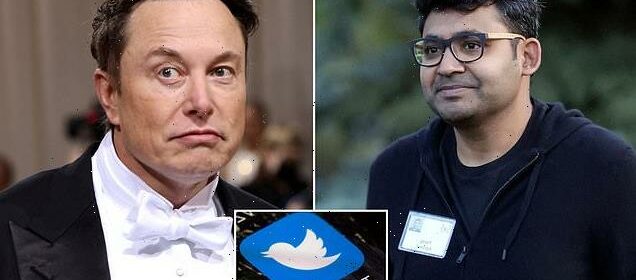

Parag Agrawal, CEO of Twitter, is shown on July 6, 2022 in Sun Valley, Idaho.

But since then, legal experts suggested that if Musk is forced to complete the acquisition or settle the dispute with a stiff penalty, he was likely to sell more Tesla shares.

Tesla shares have risen nearly 15% since the automaker reported better-than-expected earnings on July 20, also helped by the Biden administration’s climate bill that, if passed, would lift the cap on tax credits for electric vehicles.

Musk also teased on Tuesday that he could start his own social media platform. When asked by a Twitter user if he had thought about creating his own platform if the deal didn’t close, he replied: ‘X.com’

Musk sold around $8.5billion worth of shares in the electric carmaker in April as he was preparing to finance the Twitter deal. Now, he is preparing for a fire sale in the event he is forced to acquire Twitter

Source: Read Full Article