Goldman Sachs sees stocks enduring 'less pain but also no gain' in 2023

U.S. equity investors reeling from a disappointing year in the stock market may not have much to look forward to going into 2023, according to strategists at Goldman Sachs.

“In 2023, we expect less pain but also no gain,” a team led by David Kostin wrote in the bank’s 2023 equity outlook report.

The analysts detailed a scenario in which the benchmark S&P 500 is likely to remain unchanged next year, muted by zero earnings growth across Corporate America.

“The performance of U.S. stocks in 2022 was all about a painful valuation de-rating, but the equity story for 2023 will be about the lack of corporate earnings growth,” Goldman analysts wrote. “Put simply, zero earnings growth will drive zero appreciation in the stock market.”

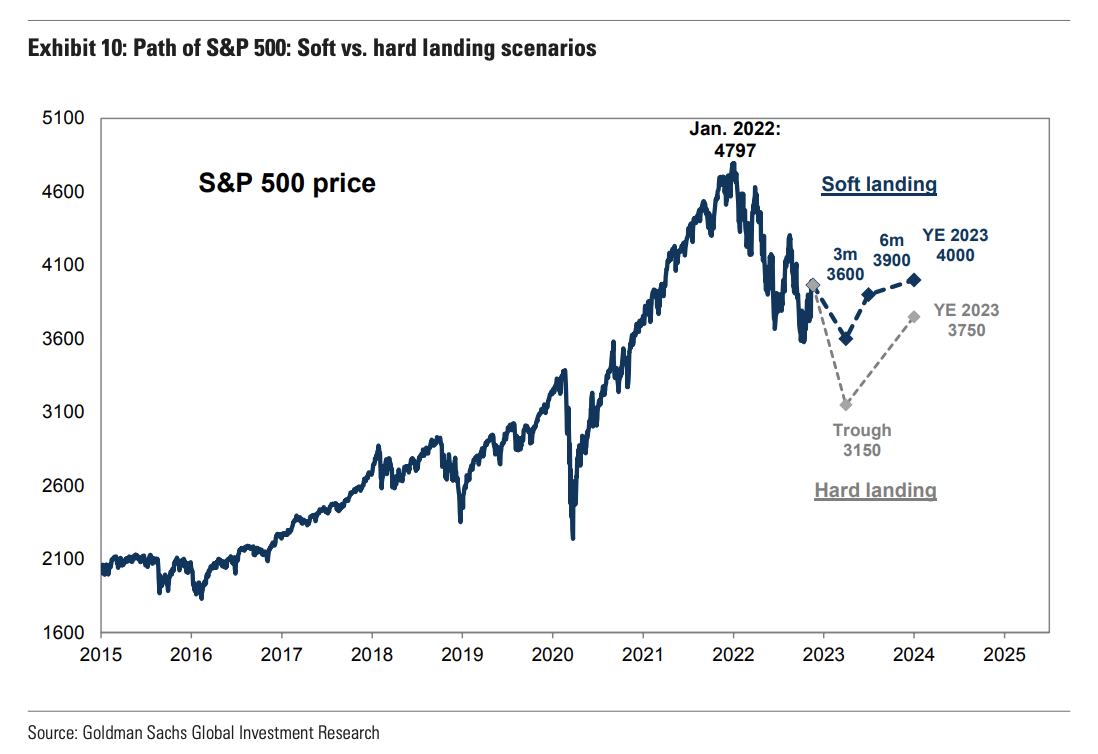

Wall Street’s premier investment bank estimates 2023 S&P 500 earnings per share will be unchanged at $224 and the index will end the year at 4,000. On Friday, the S&P 500 settled at 4,026.12.

Goldman’s three-month target for the index is 3,600 — a drop of roughly 10% from the current level as of Friday’s close — and a six-month target of around 3,900, a decrease of about 3%. No gain in the stock market is the firm's best case scenario.

If the Fed's interest rate hikes result in a sharp downturn for the U.S. economy, a "hard landing" in 2023 could see the S&P 500 fall to 3,150 in early '23, a roughly 20% drop from current levels.

“In a downside scenario, the lagged impact from cumulative Fed tightening or an exogenous shock pushes the U.S. economy into recession and drives a decline in S&P 500 EPS,” Goldman wrote.

With the Federal Reserve largely expected by Goldman Sachs and other Wall Street banks to end its monetary tightening campaign in May, strategists expect investors will shift their focus back to growth in 2024.

While Goldman’s baseline forecast assumes Federal Reserve officials will manage to engineer a soft landing — raising interest rates without triggering a painful economic downturn — the bank said a hard landing recession scenario remains a distinct risk.

The downbeat outlook comes as the U.S. central bank prepares for a potential downshift in its interest-rate hiking cycle to rein in inflation that has remained stubbornly high.

Officials have raised their key short-term interest rate from a near-zero level in March to a range of 3.75% and 4.00%, the highest since 2008. The dramatic increase in borrowing costs have already dealt a blow to equity valuations, and many Fed-watchers worry that the lagging impact may strike the economy next.

“Today, following a determined effort by the Federal Reserve to curb elevated inflation, financial conditions have tightened dramatically,” Goldman Sachs wrote. “Sharply reduced valuation for public and private firms is one painful consequence.”

Goldman pointed to the market for initial public offerings (IPO) as a “notable casualty” of the plunge in equity valuations — with only $6 billion of flotations completed year-to-date, a 95% drop from the free-money frenzy in 2021.

“Our economists expect by early 2023 it will become clear that inflation is decelerating and the Fed will reduce the magnitude of hikes and eventually cease tightening following the May FOMC meeting,” Kostin and his team wrote.

Goldman expects a 0.50% increase in the Fed's benchmark interest rate next month, followed by three more 25-basis-point hikes in February, March, and May to a terminal rate of 5.0%-5.25%.

"The policy rate will stay high in order to keep growth below-trend."

—

Alexandra Semenova is a reporter for Yahoo Finance. Follow her on Twitter @alexandraandnyc

Click here for the latest trending stock tickers of the Yahoo Finance platform

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Source: Read Full Article