Limited supply keeps Colorado’s housing market off balance

Colorado homebuyers continue to struggle with an ongoing housing shortage.

Although the Denver metro area experienced an inventory increase from 2475 active listings in February 2022 to 4108 last month, the housing market remains unbalanced, according to the Colorado Association of Realtors February report.

Last month, the monthly supply of houses statewide was just over one month, and while that’s a 120% year-over-year increase, there still need to be more homes to meet demand.

“With supply remaining low — up four times the amount from this time last year but still 75% short of anything resembling a balance of supply and demand — one would hope that more inventory and lower prices would be a positive development for the buyers who just want to get into a good home,” Realtor Matthew Leprino said in the report.

Prices tick up

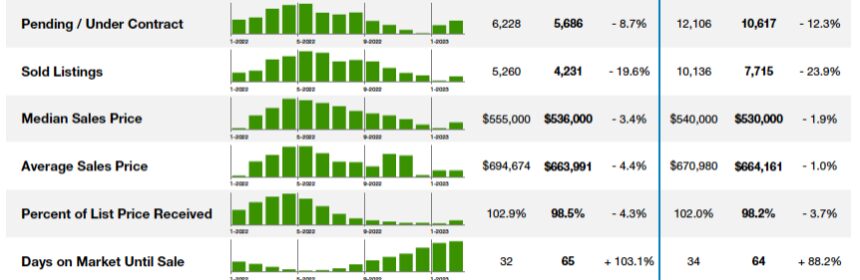

Statewide, single-family homes recorded a median price jump of 3.1%, rising from $520,000 in January to $536,000 in February.

The number of homes sold statewide dropped last month compared to February 2022 — 4231 properties changed hands — a drop of about 20% from a year ago.

In the Denver metro area, 2537 homes sold in February 2021 — down from the 2949 homes that sold last February.

The limited supply is causing home prices to climb again statewide after nine months of declines.

According to the realtor association’s monthly report, single-family homes in the Denver Metro Area saw a median price hike of 1.8%, going up from $569,804 in January to $580,000 in February.

Anticipating a strong spring

Cooper Thayer with the Thayer Group predicts a strong spring market for Douglas County.

“We are anticipating a rapid increase in the pace of the market. We’ve received a massive increase in buyer and seller activity since March began, bringing back familiar feelings from last year — and previous years,” he says.

“We believe inventory is likely to pick up over the next few months, but it is unlikely to be enough to make up for the large shortage, which will continue to hold prices up throughout the year. Overall, the Douglas County market is in a comfortable position entering the spring, and February’s stats back up steady property values regardless of moderate changes in interest rates.”

Leprino says March through July typically is the state’s busy homebuying season.

“Price increases tend to be cyclical and we see them from March through July, then they plateau and fall the rest of the year,” he says.

Although he expects prices to increase in the coming months, he doesn’t anticipate a return to last year’s bidding wars.

“Besides interest rates, there are other economic factors at play,” he says. “I don’t see people bidding properties way up since the cost of ownership has increased so much.”

The news and editorial staffs of The Denver Post had no role in this post’s preparation.

Source: Read Full Article