London will be 'sideshow' without return of VAT-free shopping

Retailers fear London will be a ‘sideshow’ for tourists without the return of VAT-free shopping, businessman says

- Shaftesbury boss said luxury retailers are diverting money away from capital

- West End landlord Brian Bickell said UK ‘was better off’ with tax break in place

London will become a ‘sideshow’ for international brands if VAT-free shopping for tourists is not restored, a major West End landlord has warned.

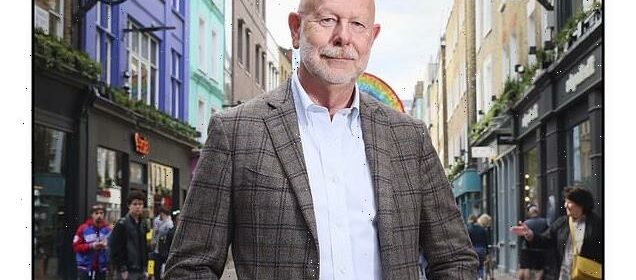

Shaftesbury boss Brian Bickell said luxury retailers are diverting money away from the capital and investing more in European rivals Paris, Milan and Rome.

The 68-year-old, responsible for swathes of Soho, Covent Garden, Carnaby Street and Chinatown, said the UK ‘was better off’ with the tax break in place.

Mr Bickell is the latest high profile boss to call for Jeremy Hunt to reinstate VAT-free shopping.

Kurt Geiger chief executive Neil Clifford, Mulberry boss Thierry Andretta and the heads of Harrods and Selfridges have all urged the Chancellor to adopt the idea.

Shaftesbury boss Brian Bickell said luxury retailers are diverting money away from the capital and investing more in European rivals Paris, Milan and Rome

It piles further pressure on Mr Hunt ahead of next month’s budget.

READ MORE: Harrods boss fears ‘tourist tax’ U-turn will lead to shoppers heading to Paris instead of London

VAT-free shopping allows tourists to claim back 20 per cent on what they buy.

It was axed by then-chancellor Rishi Sunak when the UK left the EU.

Kwasi Kwarteng tried to reintroduce the break but the current Chancellor Jeremy Hunt reversed this, claiming it would save the Treasury £2billion a year.

Critics said Mr Hunt’s decision was a ‘hammer blow’ to tourism and high streets, and would cost more in lost tax income elsewhere.

Research by leading forecaster Oxford Economics found Mr Hunt would raise an extra £350million a year in tax revenues by reinstating the measure.

Mr Bickell told the Daily Mail: ‘There was a good business case to say the UK was better off offering VAT-free shopping because of the knock-on spending in other areas.

‘But if you are just going to give up and encourage people to go elsewhere, it is not very helpful.’

A Treasury spokesman said: ‘Introducing a wide-ranging VAT-free shopping scheme would come at too high of a cost, as has been supported by previous estimates from the Office for Budget Responsibility.’

Source: Read Full Article