One in 10 homes in Sydney’s inner west is empty. The council wants them taxed

Save articles for later

Add articles to your saved list and come back to them any time.

A Sydney council has proposed a tax on empty homes to address the housing affordability crisis and increase the number of rental properties.

Inner West Council has also suggested banning no-fault evictions, lengthening tenancy periods to up to 10 years and charging higher rates to retail landlords who keep shopfronts empty.

Tenants’ Union of NSW chief executive Leo Patterson-Ross supports incentives to discourage landowners from leaving properties vacant.Credit: Nikki Short

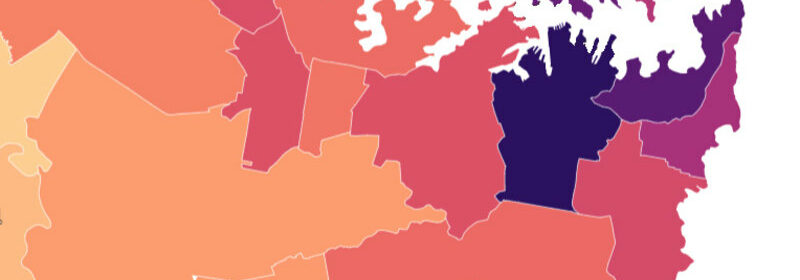

With almost 10 per cent of homes in Sydney’s inner west unoccupied, the Labor-led council last week voted to convene a renters’ rights round table to gauge support for a vacant homes tax despite the newly elected Minns government’s reluctance to consider new taxes.

“The change in government presents an opportunity to re-engage with a fresh set of policy priorities on how we can improve tenancy laws and renters’ rights,” Labor councillor Chloe Smith said.

Victoria’s Labor government introduced a vacant residential land tax in 2018 to help address a lack of housing supply.

The tax applies to homes in inner and middle Melbourne that were vacant for more than six months in the preceding calendar year.

Almost 10 per cent of homes in Sydney’s inner west were recorded as empty in the 2021 census.Credit: Steven Siewert

The federal government requires foreign owners of homes in Australia to pay an annual vacancy fee if their dwelling is not occupied or rented out for at least six months in a year.

Lane Cove Council last year called for reforms to permit higher council rates or land tax on empty homes.

Figures from the 2021 census show there were nearly 300,000 unoccupied homes across NSW – 9.9 per cent of private homes in Sydney’s inner west were vacant.

“A similar empty properties tax may be successful when applied in areas of Sydney where vacancy rates and affordability pressures are the greatest,” Inner West Council’s meeting agenda said. “It has the potential of increasing rental housing supply.”

Council documents also said money raised by the tax could help fund new social and affordable housing.

NSW Housing Minister Rose Jackson said last year, while still on opposition, it was time to have a “proper conversation” about vacant homes.

“It’s not the be-all and end-all of solving the catastrophic housing crisis that we have, but it is an important part of it, particularly in regional communities and the Central Coast,” she said.

But a spokeswoman for the minister said the NSW government was not “actively considering” a vacant property tax.

University of NSW housing research and policy professor Hal Pawson offered cautious support for a vacancy tax on “speculatively owned homes, or – in my opinion – second, third or fourth homes”.

Pawson said taxing empty homes was a good idea for countries that lack significant residential property land taxes, such as Australia.

“It is easy to propose empty property taxes, but more difficult to structure them in a legally watertight and politically acceptable way,” he said.

However, Pawson said a 5 per cent tax on empty homes in Vancouver had raked in millions of dollars and “returned” more than 4000 homes to the market.

The Tenants’ Union of NSW also supports incentives to bring properties back to usage as a residence, chief executive Leo Patterson-Ross said.

“One of the most effective forms of this is a broad-based land tax,” he said. “We think it is a fair, efficient form of taxation that discourages behaviour in property ownership such as land banking, and leaving properties vacant.”

Real Estate Institute of NSW chief executive Tim McKibbin said taxing empty homes was superficially attractive but would encroach on property rights and investment decisions.

“If councils generally really want to assist with housing supply, then processing development applications expeditiously is where they will get the biggest return for effort,” he said.

The Morning Edition newsletter is our guide to the day’s most important and interesting stories, analysis and insights. Sign up here.

Most Viewed in National

From our partners

Source: Read Full Article