Size matters when it comes to bank failures

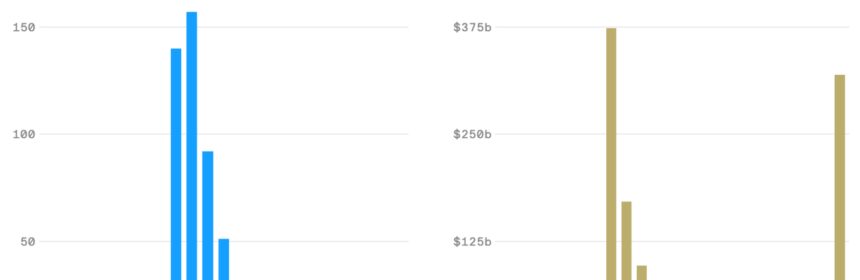

To see two bank failures in one year, as we have thus far in 2023, isn't that unusual. It's the dollar amounts that are eye-popping.

Why it matters: The size of Silicon Valley Bank is likely making it more difficult for regulators to find a buyer, which would usually be the ideal scenario for regulators cleaning up after a collapse.

- There aren't many financial institutions large enough to acquire a big regional bank with more than $50 billion in assets, current FDIC chair Martin Gruenberg said in remarks at Brookings in 2019

The big picture: The two bank failures of 2023, Signature Bank and Silicon Valley Bank, had combined total assets of $319.36 billion.

- Most bank failures are way smaller. Over 98% of banks that have failed since 2007 had assets under $10 billion, explained Gruenberg back then.

- Of note: A failed bank is one that's been taken over by regulators — so Silvergate Bank, which announced last week that it's liquidating, doesn't count.

What to watch: The FDIC is trying again to auction off SVB after a similar effort failed over the weekend.

- This time the agency has a carrot to offer acquirers. The Wall Street Journal reports that regulators can now provide a would-be buyer "deal-sweeteners such as loss-sharing agreements."

Source: Read Full Article