I was charged £470 to switch by Ovo Energy due to poor credit score – now I'm forced to eat tinned food | The Sun

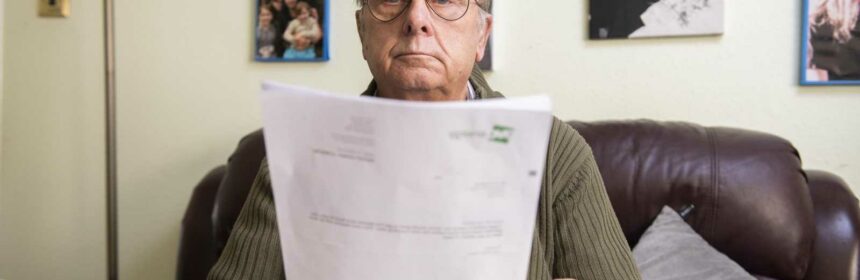

PENSIONER Steven Campbell is £470 down after paying Ovo Energy a deposit just to become a new customer due to his low credit score.

But after he was left in the dark over whether the switch had actually happened, he cancelled it – and has spent months chasing for a refund.

Steven wanted to switch from his energy company, Outfox the Market, to Ovo Energy back in June because he thought he could save money on his bills.

But the 73-year old retiree, from Swindon, was taken aback when Ovo asked him to pay a deposit of £470 due to his low credit rating.

Energy suppliers can charge a security deposit to customers looking to switch over to them.

This usually happens if a customer has a poor credit score.

Read more in Money

What to do when your energy company tells you to increase your direct debit

I’ve been threatened with bailiffs over £13,900 energy debt that’s not even mine

“I thought it was unfair, but I borrowed £300 off my daughter to help pay it,” he said.

Ovo Energy told him that he would become a customer in five to 10 days.

But he was left in the dark for over a month as to whether the switch had been successful.

He therefore cancelled the switch in August, returned to Outfox The Market, and asked Ovo Energy for his £470 deposit back.

Most read in Money

Exact dates to qualify for Christmas bonus on Universal Credit and benefits

Vodafone went down leaving hundreds of customers without internet

Pensions triple lock may STAY in huge win for millions of Brits

I bought my council house as a first-time buyer – and I got a 46% discount

Two months later and countless calls, emails and letters to Ovo Energy to get his money back, he’s still out of pocket.

“We can’t pay for other things with such a big hole in our budget,” Steven said.

“At our age we just cannot afford to have £470 that we cannot get back, our daughter is now struggling and needs her £300 back that she loaned to us.

“Missing out on £170 makes a lot of difference when you’re struggling to buy decent wholesome food.

“We’re on frozen and tinned foods, and we’re eating beans and spaghetti more than we’ve ever had.”

After The Sun contacted Ovo Energy on Steven’s behalf, his money has since been returned.

A spokesperson said: “We’re very sorry for the delay in refunding the amount to Mr Campbell. We can confirm a cheque is in the post.”

Which suppliers ask for deposits?

Ofgem says there are no rules against customers being charged a deposit in order to switch over – as long as it is clearly explained.

It usually happens when you have a poor credit score.

There’s no official cap on how much suppliers can charge – but it must be a “reasonable” amount.

Whether or not you’ll be charged a fee to switch varies between suppliers.

The Sun contacted all energy suppliers to find out their policies on charging for security deposits.

Ovo Energy asks for a deposit if a customer has a poor credit score, and the amount it charges depends on their rating.

Customers on prepayment meters looking to switch over won’t be charged, however.

Shell Energy said that a “very small number of people” who apply to switch over don’t reach its credit score requirements.

In this case, customers can pay a security deposit dependent on the customers’ score, but capped at £300 and is returned within six months.

Utilita, So Energy, Octopus and British Gas said they don’t charge switching deposits.

Read More on The Sun

I tested Aldi’s McDonald’s food dupes & one was a total 10/10

Our houses are surrounded by a CAGE after builders abandoned a whole estate

One Sun reader was charged for someone else's electricity bills – we helped him fix the error.

A couple were threatened with bailiffs over a £2,539 debt – but it wasn't theirs.

Source: Read Full Article