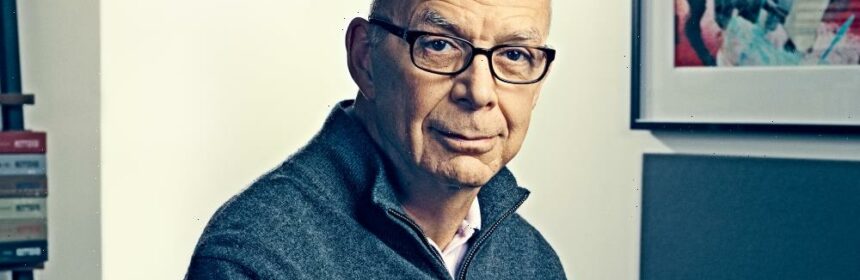

Steve Cooper Closes Out His Decade as Warner Music CEO With Strong Earnings for Quarter and Year

Steve Cooper, who steered Warner Music through a decade that saw the streaming become the primary format for the music economy, closed out his tenure as chairman and CEO with double-digit growth for the quarter and the preceding year, announced during the company’s earnings report on Tuesday. Cooper, 76, who joined the company in August of 2011 with no background in music, announced his intention to step down last June and will assist incoming chief Robert Kyncl, formerly head of business for YouTube, for a month before leaving the company in February.

Cooper is the longest-running CEO in WMG’s history, having been appointed in August 2011 after the purchase of the company by Len Blavatnik’s Access Industries. He led WMG to its IPO during the height of the pandemic in 2020, and saw it become the first music entertainment company to report streaming as its largest source of recorded music revenue and the first to partner with multiple social-media and digital platforms. In his unassuming but confident and forward-looking manner, he has led the company to a strong and steady performance over the years, regularly punching above its weight as the world’s third-largest major music company. He leaves the week after the company had a stellar showing in the 2023 Grammy Award nominations, picking up half of the 10 Album of the Year contenders and three for best new artist, seven nods for Elektra’s Brandi Carlile with seven, and six each for Atlantic’s Lizzo and 300’s Mary J. Blige. Its publishing division has songwriter of the year nominations for The-Dream and new signing Amy Allen.

That trend continued in the quarter that ended on Sept. 30: Total revenue grew 9% or 16% in constant currency, digital revenue grew 7% or 12% in constant currency, and net income was $150 million versus $30 million in the prior-year quarter.

OIBDA increased 37% to $245 million versus $179 million in the prior-year quarter or 52% in constant currency, adjusted OIBDA increased 22% to $265 million versus $218 million in the prior-year quarter or 33% in constant currency, and adjusted EBITDA increased 16% to $276 million versus $237 million in the prior-year quarter.

For the preceding 12 months, total revenue grew 12% or 16% in constant currency, digital revenue grew 9% or 13% in constant currency, and net income was $555 million versus $307 million in the prior year.

According to the announcement, recorded Music revenue was up 6.1% (or 13.1% in constant currency) due to artist services and expanded-rights revenue growth of 21.4% (or 33.3% in constant currency), reflecting an increase in merchandising and concert promotion revenue. Digital revenue was up 2.9% (or 8.1% in constant currency), which includes $31 million in downloads and other digital revenue from a September settlement with the Copyright Royalty Board. Streaming revenue was down 0.4% (or up 4.7% in constant currency). Adjusted for the impact of a new deal with one of the Company’s digital partners, Recorded Music streaming revenue was up 4.7% (or 10.4% in constant currency). Streaming revenue reflects continued growth in subscription revenue, which was affected by a market-related slowdown in ad-supported revenue.

Digital revenue represented 66.7% of total recorded music revenue versus 68.9% in the prior-year quarter. The decrease in digital revenue as a percentage of total Recorded Music revenue is due to the growth of artist services and expanded-rights and licensing revenue. Licensing revenue increased 24.3% (or 38.1% in constant currency), mainly due to higher broadcast fees, synchronization and other activity, partially offset by the impact of exchange rates. Physical revenue was down 3.1% (or up 6.0% in constant currency) primarily due to the impact of exchange rates, which offset higher vinyl sales and strong performance in Japan. Excluding the Copyright Settlement and the impact of a new deal with one of the Company’s digital partners, revenue increased 7.0% (or 14.2% in constant currency).

Major sellers included Ed Sheeran, Jack Harlow, Dua Lipa and Lizzo.

Recorded Music operating income was $165 million, up from $129 million in the prior-year quarter and operating margin was up 2.3 percentage points to 13.3% versus 11.0% in the prior-year quarter. OIBDA increased 20.3% to $219 million from $182 million (or 31.1% in constant currency) in the prior-year quarter and OIBDA margin increased 2.1 percentage points to 17.6% from 15.5% in the prior-year quarter (or increased 2.4 percentage points to 17.6% from 15.2% in constant currency). Adjusted OIBDA increased 10.8% from $204 million to $226 million (or 19.6% in constant currency) with Adjusted OIBDA margin up 0.8 percentage points to 18.2% from 17.4% in the prior-year quarter (or up 1.0 percentage points to 18.2% from 17.2% in constant currency).

Recorded Music revenue was up 9.3% (or 13.6% in constant currency) due to growth across all revenue lines, including increases in digital revenue, which reflect the continued growth in streaming, the Company’s largest source of revenue. Digital revenue was up 6.4% (or 9.7% in constant currency), which includes $31 million in downloads and other digital revenue from the Copyright Settlement. Streaming revenue was up 6.3% (or 9.5% in constant currency).

Recorded Music operating income was $796 million, up from $733 million in the prior year and operating margin was down 0.1 percentage point to 16.0% versus 16.1% in the prior year. OIBDA increased 9.3% to $1,023 million from $936 million (or 14.0% in constant currency) in the prior year and OIBDA margin remained flat at 20.6% (or increased 0.1 percentage point to 20.6% from 20.5% in constant currency). Adjusted OIBDA increased 7.3% from $975 million to $1,046 million (or 11.8% in constant currency) with Adjusted OIBDA margin down 0.4 percentage points to 21.1% from 21.5% in the prior year (or down 0.3 percentage points to 21.1% from 21.4% in constant currency).

Music Publishing revenue increased 23.9% (or 32.3% in constant currency). The revenue increase was driven by growth in digital and performance revenue. Digital revenue increased 32.5% (or 39.5% in constant currency), which includes $7 million in downloads and other digital revenue from the Copyright Settlement. Streaming revenue increased 29.8% (or 37.0% in constant currency), reflecting the continued growth in streaming services and timing of new digital deals. Digital revenue represented 62.6% of total Music Publishing revenue versus 58.5% in the prior-year quarter. Performance revenue increased due to continued growth from bars, restaurants, concerts and live events. Synchronization and mechanical revenue remained constant on an as-reported basis, but increased in constant currency. Excluding the Copyright Settlement, revenue increased 20.5% (or 28.6% in constant currency).

Music Publishing operating income was $36 million compared to $28 million in the prior-year quarter and operating margin increased 0.5 percentage points to 14.2%. Music Publishing OIBDA increased 20.4% to $59 million (or 31.1% in constant currency) and OIBDA margin decreased 0.7 percentage points to 23.2% from 23.9% in the prior-year quarter (or decreased 0.2 percentage points to 23.2% from 23.4% in constant currency). Adjusted OIBDA increased 22.4% to $60 million (or 33.3% in constant currency) and Adjusted OIBDA margin decreased 0.3 percentage points to 23.6% from 23.9% in the prior-year quarter (or increased 0.2 percentage points to 23.6% from 23.4% in constant currency).

Music Publishing revenue increased 25.9% (or 30.3% in constant currency). The revenue increase was driven by growth in digital, performance, synchronization and mechanical revenue. Digital revenue increased 29.1% (or 33.1% in constant currency), which includes $7 million in downloads and other digital revenue from the Copyright Settlement. Streaming revenue increased 28.9% (or 32.8% in constant currency), reflecting the continued growth in streaming services, the CRB Rate Benefit and timing of new digital deals. Adjusted for the CRB Rate Benefit of $20 million, streaming revenue increased 24.2% (or 27.8% in constant currency). Digital revenue represented 58.8% of total Music Publishing revenue versus 57.3% in the prior year. Performance revenue increased as bars, restaurants, concerts and live events continued to recover from COVID disruption. Synchronization revenue increased due to higher television and commercial licensing activity. The increase in mechanical revenue was partially offset by the impact of exchange rates. Excluding the Copyright Settlement and the CRB Rate Benefit, revenue increased 22.3% (or 26.7% in constant currency).

Music Publishing operating income was $139 million compared to $89 million in the prior year and operating margin increased 2.8 percentage points to 14.5%. Music Publishing OIBDA increased 32.8% to $231 million (or 38.3% in constant currency) and OIBDA margin increased 1.2 percentage points to 24.1% from 22.9% in the prior year (or increased 1.4 percentage points to 24.1% from 22.7% in constant currency). Adjusted OIBDA increased 30.2% to $233 million (or 35.5% in constant currency) and Adjusted OIBDA margin increased 0.8 percentage points to 24.3% from 23.5% in the prior year (or increased 0.9 percentage points to 24.3% from 23.4% in constant currency).

In announcing the results, Cooper said, “Our strong fourth quarter and full year results were driven by our talented artists, songwriters, and teams, across a wide range of genres, geographies, and generations. Against the backdrop of a challenging macro environment, we once again proved music’s resilience, with new commercial opportunities emerging all the time. We’re very well positioned for long-term creative success, and continued top and bottom line growth. We’re excited to have Robert Kyncl joining next year as WMG’s new CEO, as we enter the next dynamic phase of our evolution.”

Eric Levin, CFO, Warner Music Group, said, “We’ve delivered double-digit revenue growth on a constant currency basis and robust cash flow, driven by excellent operating performance across the company. The momentum in our business is strong, underpinned by global subscriber growth, subscription price increases, and the expansion of emerging platforms. As we look ahead, we’re excited to share amazing releases from the world’s hottest artists, as well as innovative tech collaborations that will strengthen our position at the intersection of music, film, TV, social media, fitness, and gaming.”

He concluded by saying on the earnings call, “Finally, Steve and I have been doing these calls together for the past eight years, and it’s been a true joy to share the mic with him. On behalf of everyone at the company, I want to thank Steve for an amazing decade of growth and success. He’s led this company brilliantly through an era of incredible change, both in our industry and in the world at large. Thank you, Steve.”

Kyncl brings strong music-industry experience to the job: YouTube is both the world’s largest video-streaming platform and the largest music-streaming platform, and he played a huge role in its negotiations with labels and publishers and generally received high marks (remarkably, considering the often-contentious relations between the two sides). He’s also pioneering force in the streaming business: Before he was chief business officer of YouTube, he led Netflix from DVDs to digital.

Cooper concluded his prepared remarks on the earnings call by saying, “At the end of September, we announced that Robert Kyncl will become co-CEO during January, and then CEO on February 1st. As an entrepreneurial leader, Robert has an impressive track record of championing change at companies like YouTube and Netflix. He’s a pioneer of the creator economy whose command of technology will enable us to unlock new opportunities for our company, our artists, and our songwriters. I have the utmost confidence that he’ll build upon our strong foundation and bring us into a new era of how music lives in the world.” He closed the call by thanking the staff and the artists for allowing him to be “a small part of the Warner Music journey.”

Read More About:

Source: Read Full Article