Investors are betting on no rate hike

Does the still simmering banking crisis mean the Fed will hit pause on rate hikes? More of the market now seems to think so.

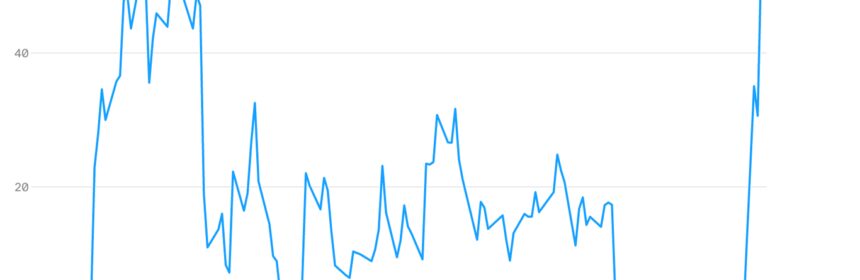

Driving the news: Numbers derived from the Fed Funds futures markets suggest more than 50% odds that the Fed won't fiddle with its key monetary policy rate at all, when its next statement comes out on March 22.

Context: Just a few days ago — before the collapse of Silicon Valley Bank and Signature Bank — the markets were pricing in a half-point hike next week to counter stubbornly high inflation.

- Yes, but: That doesn't mean investors overwhelmingly agree the romp of rate hikes is completely done. They're still putting roughly 50% odds on a quarter-point hike at the Fed's following meeting, in May.

The bottom line: The Fed is arguably the most important player in financial markets. The flurry of rate increases it delivered last year pummeled stocks, sending the S&P 500 down 19.4%, the worst annual drop since 2008.

- So, if the Fed shifts from hiking to holding steady, that's a big deal.

Source: Read Full Article