U.S. consumers have spent more than $1 trillion saved up during the pandemic

U.S. consumers have made a healthy dent in savings stockpiles accumulated during the pandemic.

And this drawdown presents a challenge for the economy in 2023.

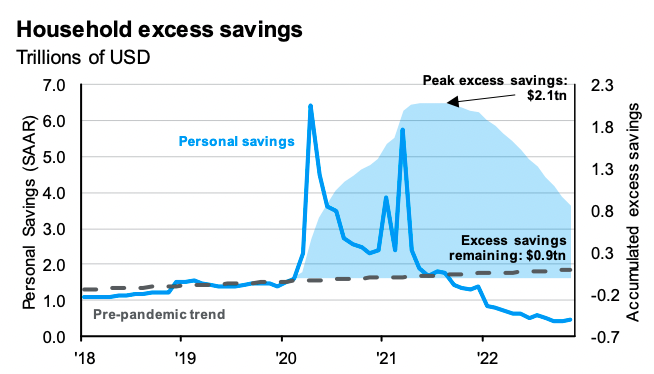

New data from JPMorgan Asset Management published Monday shows estimated "excess savings" from U.S. households now stand at $900 billion, down from a peak of $2.1 trillion in early 2021 and roughly $1.9 trillion at the beginning of last year.

These savings have been drawn down as the personal savings rate has fallen sharply from historic highs seen during the pandemic.

The latest data on personal income and outlays from the BEA, released on December 23, showed the personal savings rate stood at 2.4% in November, down from a record high of 33.6% in March 2020.

Stimulus programs rolled out during the pandemic saw a surge in the household savings rate, which typically floated in a range between 7% and 9% of income in the years before the pandemic.

Households saved more than 10% of their income in each month between March 2020 and May 2021, building a multi-trillion dollar stockpile of savings to run down in the future.

And that future is now.

As has been chronicled over the past two years, these accumulated savings for consumers have powered robust spending, even in the face of 40-year highs in inflation and a softening labor market.

But with no new stimulus programs imminent and the economy showing some signs of feeling the impact of the Federal Reserve's aggressive rate hikes, the ability for U.S. consumers to power unexpected growth will likely to come to an end.

Writing after last month's report on personal income, Oren Klachkin and Ryan Sweet at Oxford Economics said that "the historically low [personal savings rate] indicates households deployed more of their dry powder."

Klachkin added: "We believe this tailwind will fade away next year."

The exact speed, size, and scope of the economic impact of a slower drawdown in savings, however, remains a bit of a moving target.

In a piece previewing the U.S. economic outlook for 2023 last month, Ian Shepherdson at Pantheon Macroeconomics wrote: "The only reason for hesitating before forecasting a recession is that the private sector is still sitting on some substantial excess cash accumulated during the pandemic."

Shepherdson noted the drawdown in savings began last spring, as gas prices weighed on consumers nationwide. By June 2022, the average price of gas topped $5 a gallon.

In Shepherdson's view, it is likely the bottom 40% of earners have run down all excess savings accumulated during the pandemic. This suggest the pace at which consumers spend down their remaining stockpiles will slow, as those on the higher end of the income distribution have more scope to hold off drawing on savings to meet current obligations.

And while "excess savings" will likely remain part of the economic discussion in the new year, Shepherdson sees the most important driver of consumer habits coming back to the fore as the primary influence on spending in 2023: the labor market.

"The bigger problem for consumers next year likely will be the softening of the labor market," Shepherdson wrote. "The boost to job growth from post-COVID rehiring has slowed over the past year, and can be expected to fade away altogether next year."

Click here for the latest economic news and economic indicators to help you in your investing decisions

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Source: Read Full Article