You could end up with a tax burden if you win a house in a prize draw

Winning a multi-million property in a prize draw may be a dream come true… but you could end up with a big tax bill if you sell it for a profit

- Selling a home won in a prize draw may create a tax liability if it is sold at a profit

- The tax due can run into tens of thousands of pounds if the profit is significant

- We calculate the tax on a £2.5million house prize that is being sold for a profit

Winning a multi-million house in a competition may seem like a dream come true for many people.

But it can also create a tax burden if you go on to cash in and sell the property rather than move into it as your main home.

We spoke to leading accountant Nimesh Shah, of Blick Rothenberg, about the tens of thousands of pounds that could be due in capital gains tax in such circumstances.

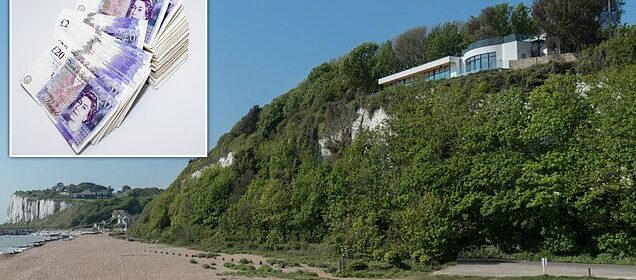

It follows a couple putting their ‘dream’ Kent property on the market for £2.65million after winning it in a prize draw only last year.

A couple put their ‘dream’ Kent property (pictured) on the market for £2.65million after winning it in a prize draw

The Midlands couple won the £2.5million luxury home via a draw on the website Omaze in the autumn last year.

They described the win as ‘beyond their wildest dreams’ and went on to say that it had changed their lives forever.

However, what they may not have known when they made the decision to sell the property is there was a potential capital gains tax liability.

Capital gains tax is a tax on the profit when you sell an asset – such as property – that has increased in value.

Mr Shah explained: ‘When someone acquires the property through a raffle in this way, their capital gains tax base cost is considered to be the market value of the property at the time they acquired it.

‘Assuming the market value of the property when it was won is £2.5million – as advertised in the raffle -, that becomes the prize winner’s capital gains base cost.

‘If they subsequently sell the property for £2.65million, they will make a capital gain of £150,000. This is calculated by taking £2.65million and subtracting their capital gains base cost of £2.5million.’

What the winners of a property in a prize draw may not have known when they made the decision to sell is there is a potential capital gains tax liability

Mr Shah went on to calculate the tax due on this capital gain, saying the capital gains annual exemption would need to be deducted, which is currently £12,300. This reduces to £6,000 from April 6, 2023 and £3,000 from April 6, 2024.

He added: ‘It would be possible for the seller to deduct any associated costs of sale, such as agent’s fees or legal costs to calculate the taxable gain.

‘If the seller is a higher rate tax payer – income over £50,270 – , the capital gain is taxed at a flat rate of 28 per cent.

‘Based on the capital gain of £150,000, the taxable gain is £144,000 – ignoring any associated costs of sale and after deducting the capital gains annual exemption of £6,000, assuming the sale takes place after April 5, 2023.’

It means that the associated capital gains tax is £40,320 – which is 28 per cent of £144,000.

The seller would need to report to HMRC and pay the associated capital gains tax within 60 days of the sale of the property.

Source: Read Full Article