Granddad denied £117k payout for botched dental work took his own life

Grandfather, 81, who suffered 14 years of agony because of botched dental work killed himself after being denied £117,000 pay out because of loophole

- Clive Worthington had failed treatment to give him dental implants and dentures

- He was awarded compensation but a legal loophole meant he never received it

A grandfather who was left in excruciating pain for 14 years after botched dental work killed himself before receiving a penny of his £117,000 compensation, his family say.

Clive Worthington had gone to a private dentist in Hungary to have dental implants and a fitted denture in 2008, but was left with a misaligned bite and trouble chewing.

The retired woodworker developed pain and repeated infections in his gums, headaches and a deviated jaw, causing him to lose weight from not being able to eat and stopping him going out.

He developed anxiety and depression, and spent an estimated £20,000 on dental and legal costs to claim compensation before eventually being awarded £117,000.

Despite this, a legal loophole meant he never received a penny, and he tragically took his own life at the age of 81 in September 2022, leaving his family devastated.

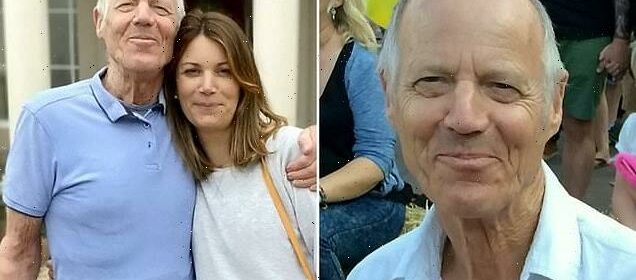

Clive Worthington, pictured, was left in excruciating pain for 14 years after botched dental work

The grandfather, pictured here with daughter Gina, tragically took his own life in September 2022

Mr Worthington’s daughter, Gina Tilly, is now attempting to get justice for her father after the ‘prolonged and failed treatment’ by his dentist.

The father-of-two, who hailed from Harlow in Essex, had gone to Europe for treatment from Perfect Profiles dentist Dr Eszter Gömbös, after his ordinary denture was causing him pain and discomfort

The new denture wasn’t fitted properly which led to chipping and cracks in the denture along with repeated infections around the implants and in the gums.

READ MORE HERE: Hidden catch that means you may not get a penny in compensation if your dentist does a botch job

Mr Worthington continued to see Dr Gömbös at one of Perfect Profile’s British branches, receiving replacement after replacement dentures and dental bridges, adding more dental implants, which caused Worthington increasing levels of pain and discomfort until 2015.

In September 2015 Dr Gömbös admitted to Mr Worthington that she was ‘at the end of her expertise’, giving him a dental tool and asking him to take it to another dental professional.

She also instructed him to seek compensation from her insurers.

He did so and took a complaint to the General Dental Council (GDC), being told the investigation would take up to six months.

It wasn’t until August 2018 that the GDC found Dr Gömbös guilty of several acts of misconduct in her treatment of Mr Worthington.

She was allowed to continue practising under several conditions, including needing supervision and declaring to any future employers her misconduct when working in the UK.

It wasn’t until four years after Mr Worthington’s case was first raised that he was awarded compensation.

In November 2019 Dr Gömbös and Perfect Profiles Ltd were instructed by the GDC to pay him £86,495.62 in damages and £30,882.80 in costs, to be paid within 14 days.

But it wasn’t paid in 14 days. The £117,378.42 he was owed wasn’t paid when he took his life in September last year and has still not been paid.

Mr Worthington, pictured here with daughter Gina, had been awarded £117,000 in compensation but didn’t receive a penny before he died

His daughter Gina, a mum of one from Portsmouth, said: ‘He was constantly going to dentists and asking if they can do anything for him.

‘It was a complete mess. In the end he just knew he wasn’t going to get the help he wanted.

‘Every time he felt like he was getting somewhere with his health or with the compensation claim- it just felt like too much to navigate.

‘These big old organisations make you feel powerless.’

The 43-year-old said: ‘I knew he’d been struggling, he was having a really hard time. I knew something was wrong but it was still a shock.’

Tearing up, she said: ‘It’s completely devastated us. My daughter doesn’t know all the details. It’s just really terrible.

‘Dad was one of ten children, so when this happened it wasn’t just about him, it had a big ripple effect.’

The delay in Mr Worthington’s compensation was due to a legal loophole called ‘discretionary indemnity’.

Dr Gömbös was insured by the Dental Defence Union (DDU), a membership organisation that supplies discretionary indemnity to cover their members for things such as conduct hearings and compensation claims against them.

READ MORE HERE: Dentist reveals the EIGHT things patients do that leave them horrified – so how many are you guilty of?

The DDU decided not to pay out the large sum of money Mr Worthington was owed, which was up to their ‘discretion’ to do without explaining why.

As Dr Gömbös is alleged to be no longer based in the UK, it is now much harder for Gina to legally go after her assets – the next legal step to having the compensation payment fulfilled.

The GDC, which registers dentists working in the UK, requires dentists to have ‘appropriate’ indemnity cover, but includes ‘discretionary indemnity’ in that definition of ‘appropriate’.

The GDC’s defence is that they are simply following the law which includes discretionary indemnity as an option, but Dr Chris Dean and Gina Tilly disagree.

Dr Dean is the Managing Director of the Dental Law Partnership, a dentist and solicitor himself who has supported countless clients who have lost out under discretionary indemnity.

He explained: ‘The underlying legal basis for the GDC’s position is the amended Dentists Act 1984, requiring ‘appropriate cover’ for dentists including membership of mutual insurance (such as the DDU which is a membership organisation) as an option.

‘The GDC say because it’s the legislation, that’s enough. We say the GDC is interpreting the phrase ‘appropriate’ as allowing discretionary cover to also count as suitable- when it is blatantly not.

‘The GDC don’t want to remove discretionary cover from their list of ‘appropriate’ cover.’

He added: ‘The problem lies with the acceptability of dentists being members of a mutual society by the GDC as amounting to appropriate indemnity cover.

‘These unregulated mutual societies are more than 100 years old, and they come from a time when dentists knew best, as doctors and dentists clubbed together to support themselves and protect themselves in these.’

After a compensation claim is turned down under a discretionary cover, Dr Dean says there are ‘no more routes to go down’ unless you can chase the individual dentist’s assets, such as liquid funds, their house or their car.

The GDC is the regulator for dentists, which means Gina is now stuck in this legal loophole.

Dr Dean says if the GDC changes their position on discretionary indemnity now, it opens itself up to litigation by unhappy claimants like Mr Worthington’s family and other clients of his.

He said: ‘If the GDC won’t act on this, the government needs to, and quickly.’

Gina said: ‘I want to make sure no one else has to go through what our family has gone through.

READ MORE HERE: Is YOUR area a ‘dental desert’? Use our fascinating interactive map to find out as shock data shows up to 13k patients compete for ONE NHS dentist practice in England’s worst-affected areas

‘I’m still yet to understand how this is allowed to happen. It appears the GDC has chosen to support unregulated dentist societies over the patients it is supposed to protect.’

The GDC’s motto is ‘protecting patients, regulating the dental team’.

Gina added that her father who was a joyful and social man lost all social life after his failed dental treatment: ‘The main problem was the pain.

‘He stopped going out and doing the things he loved.

‘He couldn’t sleep from the pain. I rarely saw him without him mentioning it. He was somebody who made everybody laugh.’

The GDC won’t comment on individual cases but said: ‘Patients must be able to seek compensation in the rare event that something goes wrong in their dental care.

‘It is deeply frustrating that weaknesses in the current legislation caused the system to fail in this instance.

‘We encourage the Department of Health and Social Care to accelerate their work to review and update the existing provisions, which we as regulator can then apply.’

The DDU commented: ‘We are unable to comment on individual cases.

‘We would however point out that the DDU is part of a not-for-profit mutual membership organisation which provides its members with indemnity for clinical negligence claims for treatment provided in the UK and Ireland.

‘It is rare that we are unable to offer our members support: over the past five years we have assisted well over 99.5% of members who have approached us for support with claims and other legal matters.’

Dr Gömbös and Perfect Profiles have been contacted for comment.

Source: Read Full Article