Student loans: Biden administration 'terminates' status of troubled college accrediting agency

The Education Department (ED) revoked the accreditation status of the Accrediting Council for Independent Colleges and Schools (ACICS) after years of scandals related to for-profit schools and the student loans provided to students across the country.

“ACICS is no longer a nationally recognized accrediting agency and can no longer serve as a ‘gatekeeper’ of institutional eligibility for federal student aid programs,” the ED stated in an announcement titled: “U.S. Department of Education Terminates Federal Recognition of ACICS.”

The non-profit education corporation accredited now defunct for-profit schools ITT Tech and Corinthian Colleges. Many students enrolled at these schools didn’t have transferable credits nor promised degrees. ACICS was also accused of double dipping in taxpayer funded pandemic PPP loans and coronavirus stimulus payments.

“ACICS accredited the worst of the worst scam schools, including Corinthian, ITT Tech and Art Institute and a school that didn’t even exist,” Thomas Gokey, an organizer with the Debt Collective, said in a statement. “These schools never should have been allowed to access federal funds, and the harm they have done to millions of students can only be repaired by full cancellation and a commitment to fund high quality public college for all.”

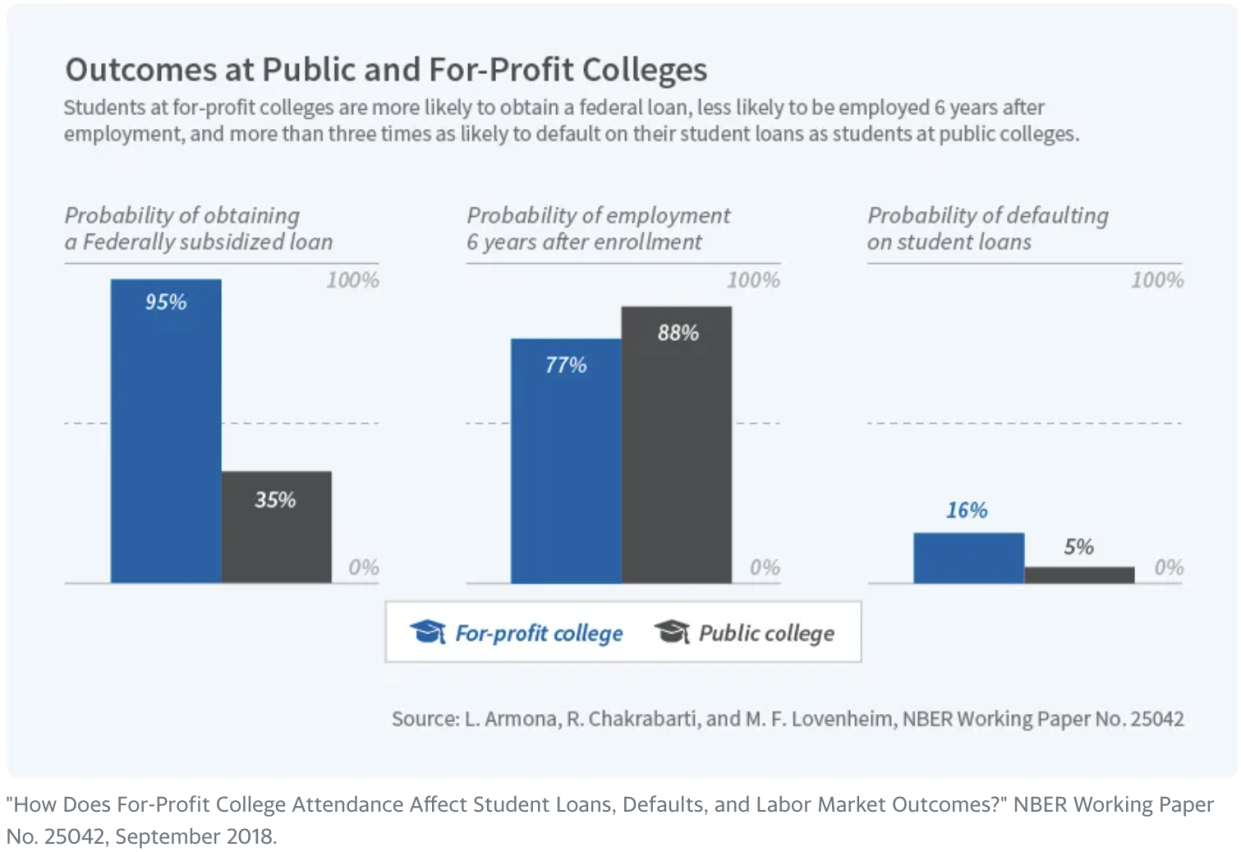

A 2018 NBER working paper found that students who attended for-profit colleges were more likely to obtain a federal loan than those who attend a public college and three times more likely to default on student loans — driven by the fact that these students were six times less likely to receive employment after enrollment compared to their public college peers.

In 2016, the Obama-era ED stripped ACICS of its status as an accrediting agency. At the time, ACICS had already accredited 237 schools that enrolled 361,000 students receiving federal financial student aid. In 2018, the Trump-era ED reinstated ACICS. However, in 2020, after a damning USA Today report detailing how ACICS accredited a school that reportedly had zero students and no faulty or classrooms, the ED launched an investigation into ACICS.

“We are talking about an entity that accredited a school that didn’t even exist and continues to rubber stamp some of the worst for-profit colleges,” Eric Rothschild, director of litigation at the National Student Legal Defense Network, said in a statement. “Students count on accreditors to validate that the schools where they spend their time and money will meet a baseline level of quality.”

When Biden took office in January 2021, career officials at the ED recommended that ACICS, which was founded in 1912, be disempowered once again. The officials stated that ACICS “fails to demonstrate compliance” with regulations and that “provides a stand-alone basis for termination.”

“Accrediting agencies are often the only barrier between predatory for-profit colleges and access to millions of dollars in federal aid,” Cody Hounanian, executive director of the Student Debt Crisis Center, said in a statement. “Without proper accountability, these schools make huge profits and leave American families crushed by student debt and without a valuable degree. Today’s action is a small step towards cleaning up the exploitative elements of America’s higher education system. However, there is more work to be done to hold all bad-actors accountable and to provide financial relief to individuals who have been harmed.”

Predatory lending at for-profit schools exacerbated the student debt crisis, which has ballooned to more than $1.7 trillion.

“The Department of Education’s latest announcement regarding the ACICS is good news for both students concerned about attending a school that will provide them with adequate education, as well as for taxpayers who are worried that their money will go to waste at fraudulent institutions,” Jacob Channel, senior economist at Student Loan Hero, said in a statement.

President Biden currently faces a decision whether to cancel some student loan debt ahead of the August 31st deadline for pandemic forbearance of federal student loans.

Aarthi Swaminathan contributed to this article.

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Money.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.

Source: Read Full Article